Gap-filling Setup (Profitable way to trade)

- The_Chartist

- Nov 5, 2024

- 3 min read

Before we proceed further, it is too important to understand "gap" on a chart.

What is a gap?

It is an area or a zone where no transaction took place between a buyer and a seller. For instance, let say, the price closed at 102 on Monday and there is some overnight news regarding a new launch of a product or a service or new appointment in the Board, the stock the next day opens up at 106 as the buyer is willing to pay a higher price. The whole day the stock stays above 106 and therefore, the area between 102 and 106 becomes a void. It means there is no transaction that took place between the buyer and seller in this zone.

This gap is called an "upside gap". It is one of the strongest gap as it depicts the strength of the buyer. In fact, many strong moves starts from a gap. In 1930s in the Technical Analysis literature - they were called by different names as "breakaway gap" or a "runaway gap". Today, you have have heard a popular term called as "episodic pivot" for the same. If you understand the psychology well that because of some positive reason the buyers are willing to pay a higher price, you need not worry for what is it called. Let us see some examples of upside gaps:

Anand Rathi (post-earnings gap)

Narayan Hrudalaya (post earnings gap)

In both the cases, you will notice - one common thing. Both the gaps are still open till now. Therefore, please do note that the gap once formed need not to be filled always. This is a myth that gap has to be filled always. In some cases, they doesn't.

Now, let us take some examples of downside gaps. But, what do you think - who is strong in here? Buyers or the sellers. The underlying news is negative and therefore the seller is willing to get out at whatever price.

Yes Bank (and the rest is history)

But - how do we make money out of them? Obviously, upside gaps are strong when accompanied by some news and to be considered for opening the long positions. But equally profitable are the downside gaps on a chart. Just when the downside gap is formed, sellers panic and often even the good businesses fall off the cliff due to temporary news. We don't need to act immediately. What I look for is if the price has the strength to close that gap once again. If it does so, I go long in the security by keeping my stop at a logical area.

There are plenty of examples I've traded and tweeted publicly on my profile.

IIFL Securities (downside gap was filled by the stock): The downside gap of 5th March was filled by the stock on 15th May and gave one profitable opportunity to go long.

EMS Limited (gap filled)

Polycab (downside gap that was created due to temporary news of Income Tax got filled a few days later)

By sharing the above charts, I don't mean that all gaps will be profitable. Some will show you a false move and go back to the downside. But, it is definitely keeping a close eye on these stocks have downside gap as they are less in number and easy to track for a beginner.

Can we see some live examples?

Indigo (gap created due to reported loss and grounding of planes)

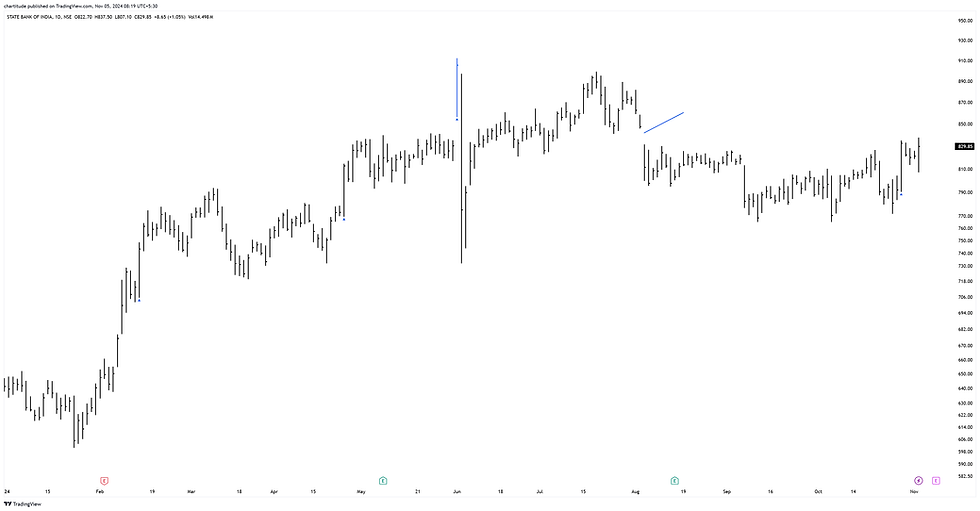

SBIN ( result is close and can it fill the downside gap? Let us see)

DGF as I call it - downside gap filling) is one of the most profitable strategy as I've myself studied on the previous stock charts. For every beginner, your job is to spot the stocks that have recent downside gap - preferable within a year and now the stock is trying to fill it. If it succeeds, you can think of going long and make the maximum of it.

It is a strategy that demands less hard-work with equally more profitable trades. Less trades but more money and therefore, less headache.

I have explained all the gaps in detail on my platform: My Website (you can refer that)

I will keep on writing, See you soon. Thanks

Comments